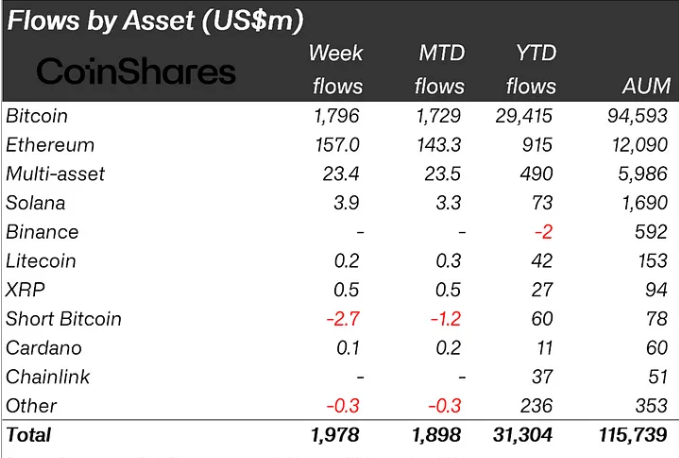

Umakyat sa $1.98 billion ang inflows ng crypto investment pagkatapos ng eleksyon, habang euphoric pa rin ang markets sa panalo ni Donald Trump. Ito na ang ikalimang sunod na linggo ng inflows, na nagtulak sa year-to-date (YTD) totals na umabot sa hindi pa nararanasang $31.3 billion.

Malaking factor sa boost ng investment pagkatapos ng eleksyon ang sunod-sunod na all-time highs ng presyo ng Bitcoin kasunod ng resulta ng US presidential elections.

Pasok ng Pera sa Crypto Umabot ng Halos $2 Billion Pagkatapos ng US Elections

Ang positive na flows ng crypto investment ay nagpapakita ng tumaas na confidence ng investors sa digital assets habang umabot sa $20 billion ang trading volume. Ganun din, umakyat din sa bagong high ang global assets under management (AuM), na naging $116 billion.

Bitcoin ang nanguna sa rally pagkatapos ng eleksyon na may halos $1.8 billion na inflows. Sinuportahan ito ng bullish price movements across key digital assets. Una sa lahat, umabot sa initial peak ang Bitcoin agad pagkatapos ng US presidential elections. Ang panalo ni Donald Trump, na nagbalik ng conservative economic stance sa White House, ay lalo pang nagpaigting sa appeal ng Bitcoin sa mga risk-on investors.

“Ang kombinasyon ng bullish macro environment at malaking pagbabago sa US political system ang malamang na dahilan ng ganitong supportive na sentiment ng investors,” sabi sa latest report ng CoinShares dito.

Ang broader sentiment shift ay nagpapakita ng renewed interest sa mga assets outside traditional finance (TradFi). Lalo na ito bilang tugon sa mga takot sa inflation at pagbaba ng interest rates ng US Federal Reserve. Simula September, nag-adopt ng dovish approach ang Federal Reserve, at nakakuha ang Bitcoin ng mahigit $9 billion na inflows.

Ang market optimism sa economic policies ni Trump ay nagdulot din ng risk-on shift. Pinataas nito ang demand para sa Bitcoin at iba pang high-risk assets sa cryptocurrency space. Specifically, nakakita ang blockchain-related equities ng $61 million na inflows. Ang interest sa blockchain equities, na representasyon ng shares sa mga companies involved sa blockchain at cryptocurrency sectors, ay nag-highlight sa appetite ng investors para sa mas diversified exposure sa lumalagong crypto market.

With Trump’s return to office, maraming analysts expect his administration to be more accommodating to financial innovation. This would encourage further growth in blockchain-based financial services and products.

“DeFi will get better regulatory treatment — no more harassment and potentially even enabling things like fee switches or network-based dividends,” Pahueg, a popular voice on social media platform X, stated.

The post-election period has also seen notable inflows into Bitcoin ETFs (exchange-traded funds), adding momentum to the financial instrument’s overall growth. Spot Bitcoin ETFs, which provide direct exposure to BTC, experienced a record level of inflows. This is as investors increasingly seek regulated pathways to invest in the pioneer crypto.

Risk-on ETFs, which typically see growth in more adventurous market climates, have similarly benefited from the election results. The Trump victory has bolstered these funds, which aim to capitalize on higher returns in volatile environments. The influx of investment into these ETFs highlights the heightened risk tolerance among investors.

With mainstream investors gaining more access to the digital asset market, crypto ETFs have become a cornerstone of Bitcoin’s recent surge. The inflows suggest heightened confidence in Bitcoin’s long-term viability. The belief that BTC can perform as a store of value amidst economic uncertainty is also growing.

This post-election period, marked by a dramatic influx of capital, signals a potential inflection point for cryptocurrency markets. The return of a conservative administration, coupled with supportive macroeconomic policies, is fostering a risk-tolerant environment conducive to digital asset growth.

The record-breaking inflows into Bitcoin, Ethereum, altcoins, and related ETFs indicate that investors are increasingly willing to explore alternative assets that protect from traditional market uncertainties.

As of this writing, Bitcoin is trading for $82,376, having risen by almost 4% since the Monday session opened. As the king of crypto looks poised for more gains, positive US economic data this week could send BTC to unchartered territory.

“We anticipate a slightly higher CPI reading; however, we expect Bitcoin to remain resilient, given that the Fed is already moving toward rate cuts. Retail sales are likely to show strength, driven by Amazon’s recent sales event, signaling a robust economy that could further support crypto markets. Overall, macro data should point to stronger economic growth, which Bitcoin is likely to view favorably,” Markus Thielen, Founder & CEO at 10x Research, told BeInCrypto.

Disclaimer

Alinsunod sa mga patakaran ng Trust Project, ang opinion article na ito ay nagpapahayag ng opinyon ng may-akda at maaaring hindi kumakatawan sa mga pananaw ng BeInCrypto. Nananatiling committed ang BeInCrypto sa transparent na pag-uulat at pagpapanatili ng pinakamataas na pamantayan ng journalism. Pinapayuhan ang mga mambabasa na i-verify ang impormasyon sa kanilang sariling kakayahan at kumonsulta sa isang propesyonal bago gumawa ng anumang desisyon base sa nilalamang ito. Paalala rin na ang aming Terms and Conditions, Privacy Policy, at Disclaimers ay na-update na.